Medicare Advantage and Part D Final Rule for Contract Year 2025: Key Takeaways for Healthcare Payers and Pharmacies

The Centers for Medicare & Medicaid Services (CMS) recently released the final rule for Contract Year 2025 Medicare Advantage and Part D (CMS-4205-F). The rule brings significant updates designed to refine the Medicare program to serve enrollees better, enforce new protections, and bolster competition within the marketplace. The following summary emphasizes how the changes impact healthcare payers and pharmacies.

New Compensation Guardrails for Agents and Brokers

Agents and brokers are crucial in assisting Medicare beneficiaries in selecting appropriate health plans. The 2025 final rule introduces stricter guidelines to curb compensation practices that might incentivize these agents to prioritize financial gains over the enrollee's healthcare needs, indicating that compensation must not incentivize unnecessary plan changes.This aligns with CMS’s goal of promoting stability and integrity in plan choices by eliminating incentives for agents to promote switches that may not be in the beneficiaries' best interests.

This move aims to:

- Standardize a fixed compensation amount for all plan enrollments, reducing biases driven by varying commission structures.

- Prohibit contract terms with third-party marketing organizations that could negatively influence agent or broker recommendations.

For healthcare payers, this translates to a more ethical and competitive environment that fosters trust with beneficiaries. Meanwhile, pharmacies may see a more balanced distribution of enrollees across plans, which might affect their patient profiles and associated revenue from Medicare plans.

Tightened Regulations on Personal Beneficiary Data

CMS is cracking down on the sale and resale of personal beneficiary data to defend against aggressive marketing practices. Under the new rules:

- Third-party marketing organizations must receive clear, written consent from the individual before sharing their data for marketing or enrollment purposes.

- Consents are required for each third-party entity, aligning with FTC and FCC regulations.

This change could lessen the volume of cold contacts for healthcare payers, encouraging them to seek more consent-driven approaches for customer outreach. Pharmacies could benefit from a decrease in the misuse of beneficiaries' contact information, potentially reducing instances of beneficiaries being bombarded with marketing calls that could affect their pharmacy choice.

Network Adequacy and Enhancements in Behavioral Health Access

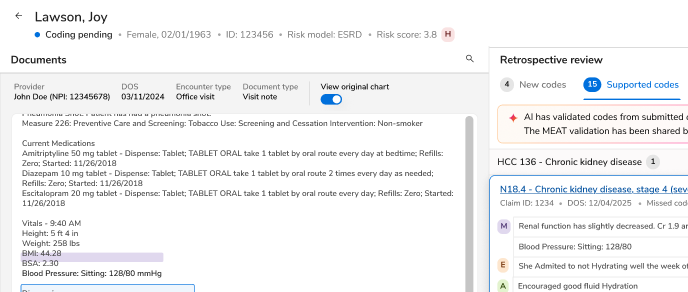

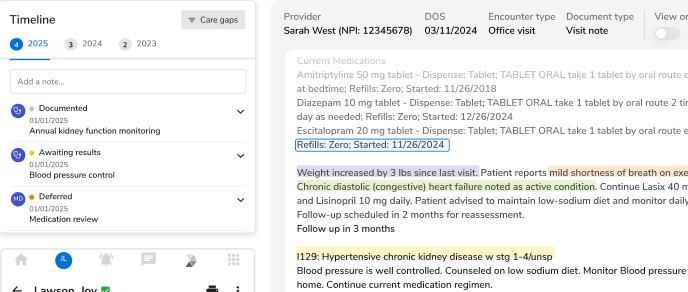

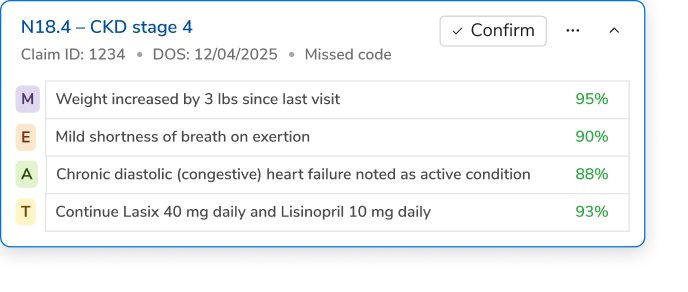

As part of the proposed changes to the list of facility specialty types under § 422.116(b)(2), CMS has proposed base time and distance standards in each county type for the new specialty type as highlighted in the chart.

Anticipating the increasing importance of mental health services, CMS introduced new network adequacy standards:

Anticipating the increasing importance of mental health services, CMS introduced new network adequacy standards:

- A new facility-specialty category dubbed “Outpatient Behavioral Health” includes marriage and family therapists, mental health counselors, and more under one umbrella.

- Medicare Advantage plans are now required to verify the expertise of non-physician providers in behavioral health to be included in the network.

This move, aimed at improving access to mental health services, underscores an increased CMS focus on mental health and substance use disorder treatments. CMS is driving network adequacy improvements, requiring Medicare Advantage plans to incorporate a broader spectrum of behavioral health providers.These adjustments seek to increase the availability of mental health services, which is a boon for both payers and pharmacies. Healthcare payers will be tasked with augmenting their networks to meet these standards. At the same time, pharmacies could potentially engage with more patients seeking behavioral health medications, thus necessitating an understanding of the broader spectrum of covered services in this category.

Mid-Year Supplemental Benefit Notifications

The rule mandates that any new supplemental benefits available mid-year must be communicated to enrollees. This ensures that beneficiaries are informed and can leverage additional benefits they may not be aware of. Healthcare payers must incorporate strategies to inform their members appropriately, while pharmacies may need to adapt to shifts in demand for certain medications or services tied to these new benefits.

Enhanced Focus on Accurate Information Dissemination

In the final rule, a significant emphasis in the 2025 rules is placed on ensuring beneficiaries receive accurate information that aids in decision making. The new rule stipulates that all materials provided to beneficiaries be straightforward and accurate to prevent confusion and misrepresentation of benefits.New Marketing and Communication RequirementsThe final rule specifies tighter regulations surrounding marketing by third-party brokers and agents. This includes limits on how beneficiary contact information can be used and stricter oversight of marketing strategies to prevent misleading information from reaching Medicare enrollees. Enhanced consent requirements will ensure that beneficiaries have greater control over their personal information.Enhanced Integration Requirements for D-SNPsOne notable part of the 2025 Final Rule is its focus on improving the coordination and delivery of benefits for individuals who are dually eligible for Medicare and Medicaid, specifically those enrolled in D-SNPs. The rule advances requirements for these plans to integrate Medicare and Medicaid services more seamlessly, thereby fostering a more unified healthcare experience for dual-eligible beneficiaries.

As the

Federal Register highlights, D-SNPs will face stricter regulations designed to enhance coordination between Medicare and Medicaid benefits. This includes mandating D-SNPs to facilitate more effective sharing of health risk assessments and care management plans between Medicare and Medicaid providers. These changes aim to improve healthcare outcomes for dually eligible beneficiaries by ensuring they receive holistic, coordinated care and simplify the complexity traditionally associated with navigating the two distinct programs.Such integration seeks to address critical gaps in care, especially for the most vulnerable populations, underscoring CMS's commitment to advancing health equity and reducing administrative burdens for beneficiaries.Extended Reach of Telehealth Services

As the

Federal Register highlights, D-SNPs will face stricter regulations designed to enhance coordination between Medicare and Medicaid benefits. This includes mandating D-SNPs to facilitate more effective sharing of health risk assessments and care management plans between Medicare and Medicaid providers. These changes aim to improve healthcare outcomes for dually eligible beneficiaries by ensuring they receive holistic, coordinated care and simplify the complexity traditionally associated with navigating the two distinct programs.Such integration seeks to address critical gaps in care, especially for the most vulnerable populations, underscoring CMS's commitment to advancing health equity and reducing administrative burdens for beneficiaries.Extended Reach of Telehealth Services

The rule’s provisions aim to expand telehealth services, making it easier for patients to receive care where and when they need it, particularly in rural areas. This expansion improves access to healthcare services and opens doors for new telehealth modalities to be included in Medicare plans. By integrating these insights, we can see the broader impacts of the 2025 Final Rule, emphasizing a tighter regulatory environment, enhanced beneficiary protections, and significant adjustments in the operational landscape for healthcare payers and pharmacies.Implications for Pharmacies

The final rule focuses on pharmacy performance measures and stresses fair and transparent plan offerings and improved healthcare access, including behavioral health. Pharmacies may need to recalibrate their strategies to align with these principles, particularly around comprehensive care and patient privacy. Changes to compensation structures and tighter data protection controls may also redirect pharmacies' marketing strategies and patient engagement approaches.

New Compensation Rules for Agents and Brokers

- This change aims to stop anti-competitive steering by setting a clear, fixed compensation amount for agents and brokers, regardless of the Medicare Advantage or Part D plan individuals enroll in. This fixed compensation is expected to remove incentives for agents and brokers to steer individuals to plans that may not best meet their healthcare needs but offer higher commissions.

- For pharmacies, this could mean a more leveled playing field among Medicare Part D plans, potentially affecting how pharmacy services are utilized based on the fairness of plan offerings rather than the influence of agent or broker incentives.

Restrictions on Beneficiary Data Sharing

- The final rule restricts third-party marketing organizations (TPMOs) from selling or reselling personal beneficiary data, a practice that can lead to aggressive marketing tactics.

- Pharmacies might see a change in how beneficiary data impacts marketing strategies, influencing the way pharmacies interact with Part D plans and beneficiaries, especially concerning privacy and data protection.

Expanded Access to Behavioral Health Services

- CMS is enhancing network adequacy standards, including a new facility-specialty category for Outpatient Behavioral Health. This will broaden the types of providers considered adequate in a network, including opioid treatment programs and community mental health centers.

- Pharmacies, especially those with medication therapy management (MTM) services and a focus on behavioral health, might experience an increased collaboration with Medicare Advantage plans. This could impact pharmacies by potentially increasing the volume of prescriptions and MTM opportunities related to behavioral health services.

Implications for Pharmacy Operations and Strategy

- The final rule's emphasis on equitable, transparent plan offerings and improving access to care, including behavioral health, could influence pharmacies in several ways. Pharmacies may need to adjust their strategies to align with these new standards, focusing on comprehensive care and patient privacy.

- The adjustments in broker and agent compensation, along with tightened controls on beneficiary data, might also influence pharmacies' marketing strategies and patient outreach efforts.

The Contract Year 2025 Medicare Advantage and Part D Final Rule (CMS-4205-F) will necessitate strategic adjustments for pharmacies in several key areas:

- Patient Engagement and Marketing:

- Pharmacies will need to revisit their patient engagement and marketing strategies in response to changes in how agents and brokers are compensated, as well as the new limitations on the distribution of personal beneficiary data. With the elimination of incentives for agents to steer beneficiaries toward certain plans, pharmacies may see a shift in which Medicare Part D plan beneficiaries are enrolled. As a result, pharmacies must adapt their marketing strategies to target a potentially broader or different customer base, emphasizing the value and quality of their services.

- The prohibition against TPMOs selling personal beneficiary data means pharmacies will have less access to targeted marketing information, which may lead them to adopt more generalized but innovative marketing approaches that respect beneficiary privacy.

- Service Utilization and Offerings:

- The equalization of plan compensation could result in a more diverse set of Medicare Part D plans being represented among pharmacy customers. Pharmacies may need to ensure they can efficiently process and manage benefits under a wider array of plans.

- With the expanded access to behavioral health services through improved network adequacy standards, pharmacies, particularly those offering Medication Therapy Management (MTM) and focusing on behavioral health, will likely see an increase in the demand for their services. This will require pharmacies to possibly bolster their capabilities in managing and dispensing medications for behavioral health conditions and expanding their consultation services to include more comprehensive support for patients with these needs.

- Privacy and Data Protection:

- Given the tighter controls on beneficiary data, pharmacies will need to emphasize data protection and privacy in their operations more strongly. This not only involves complying with the new restrictions but also leveraging these changes as a point of trust and differentiation in patient outreach and engagement strategies. Pharmacies might need to invest in technologies and protocols that ensure data privacy and demonstrate to beneficiaries their commitment to protecting sensitive information.

- Strategic Alliances and Collaborations:

- To capitalize on the increased focus on behavioral health, pharmacies may consider forming or strengthening partnerships with behavioral health providers and Medicare Advantage plans to offer enhanced benefits in this area. This could involve creating integrated service models where pharmacists play a more active role in the healthcare team, especially for patients with behavioral health conditions, thus fostering a collaborative approach to patient care.

The Contract Year 2025 Medicare Advantage and Part D Final Rule (CMS-4205-F) introduces several changes aimed at promoting fair competition, protecting consumer interests, and improving access to healthcare services, including behavioral health. Pharmacies are likely to be impacted by these changes through adjusted prescription drug plan dynamics, potentially modified patient engagement strategies, and possibly increased opportunities for providing medication-related services, especially in the realm of behavioral health. Adapting to these changes will be crucial for pharmacies to continue effectively serving Medicare beneficiaries.

Critical Impact on Formularies

The Pharmacy Quality Solutions summary also references upcoming changes in how drug formularies work. The 2025 rule may tighten standards around formulary changes during the contract year, which could impact how pharmacies manage their inventory and advise on medication therapy management. Pharmacies must stay updated on these changes to ensure compliance and optimal service delivery.A New Outlook for Healthcare Ecosystem Ushered in by the Final Rule Changes

The Final Rule for Contract Year 2025 presents pivotal changes for Medicare Advantage and Part D plans that emphasize fair competition, transparency, and improved access to care. While introducing new operational challenges, these regulations offer a chance for healthcare payers and pharmacies to refine their strategies to thrive in a reformed Medicare landscape.Through the integration of services and the emphasis on high-quality, coordinated care, the CMS Final Rule for 2025 represents a significant step forward in improving the healthcare landscape for dually eligible beneficiaries, indicating a broader move towards a more inclusive and efficient healthcare system.The introduction of these comprehensive changes promises to impact payers and pharmacies significantly by ushering in stricter regulations, enhanced transparency, and a stronger focus on beneficiary protections. For healthcare payers, these changes mean adapting to new compensation structures for agents and brokers, tighter marketing and communication requirements, and enhanced integration needs for Dual Eligible Special Needs Plans (D-SNPs).These adjustments are geared toward fostering a competitive and ethical environment that emphasizes the healthcare needs of enrollees over financial incentives. Moreover, expanding telehealth services and including outpatient behavioral health categories under network adequacy requirements highlight a shift towards broadening access to care, particularly in mental health services, which can lead to an increased demand for integrated health services and potentially reshape the delivery of care.

For pharmacies, the Final Rule spells a push towards accountability and quality, underscored by greater emphasis on performance measures that influence Star Ratings. With forthcoming changes to drug formulary standards, pharmacies are prompted to fine-tune their inventory management and medication therapy management practices to meet the heightened standards.The rule's protective measures against the aggressive marketing and mishandling of personal beneficiary data are likely to reduce unwanted solicitations, thereby refining the communication landscape pharmacies and healthcare payers navigate.The rule revisions for the contract year 2025 facilitate a landscape where both healthcare payers and pharmacies must navigate new challenges but also enable them to seize the opportunities to enhance service quality, operational efficiency, and patient care in alignment with CMS's vision for a more transparent, accessible, and beneficiary-centric Medicare ecosystem.

.png)

.avif)

.svg)

.svg)

.svg)