How to perform accurate risk adjustment and manage care

The Centers for Medicare & Medicaid Services' (CMS) defines risk adjustment as "a statistical process that takes into account the underlying health status and health spending of the enrollees in an insurance plan when looking at their health care outcomes or health care costs." These days, most healthcare organizations assess risk through retrospection i.e., by analyzing historic clinical records and healthcare data to understand patients' relative health. However, in order to better understand patient health and manage care appropriately, we need more than a view of the past. Accurate and efficient capture of a member's risk requires a forward-looking, prospective view of patient conditions and treatments.

Vitality of Risk Adjustment Today

Multiple VBC contracts risk-adjust the payment based on the type of population being served. These range from moderate to more severe, making it important to have an accurate assessment of the risk to get paid appropriately. The implications of risk adjustment vary by contract type and risk model:

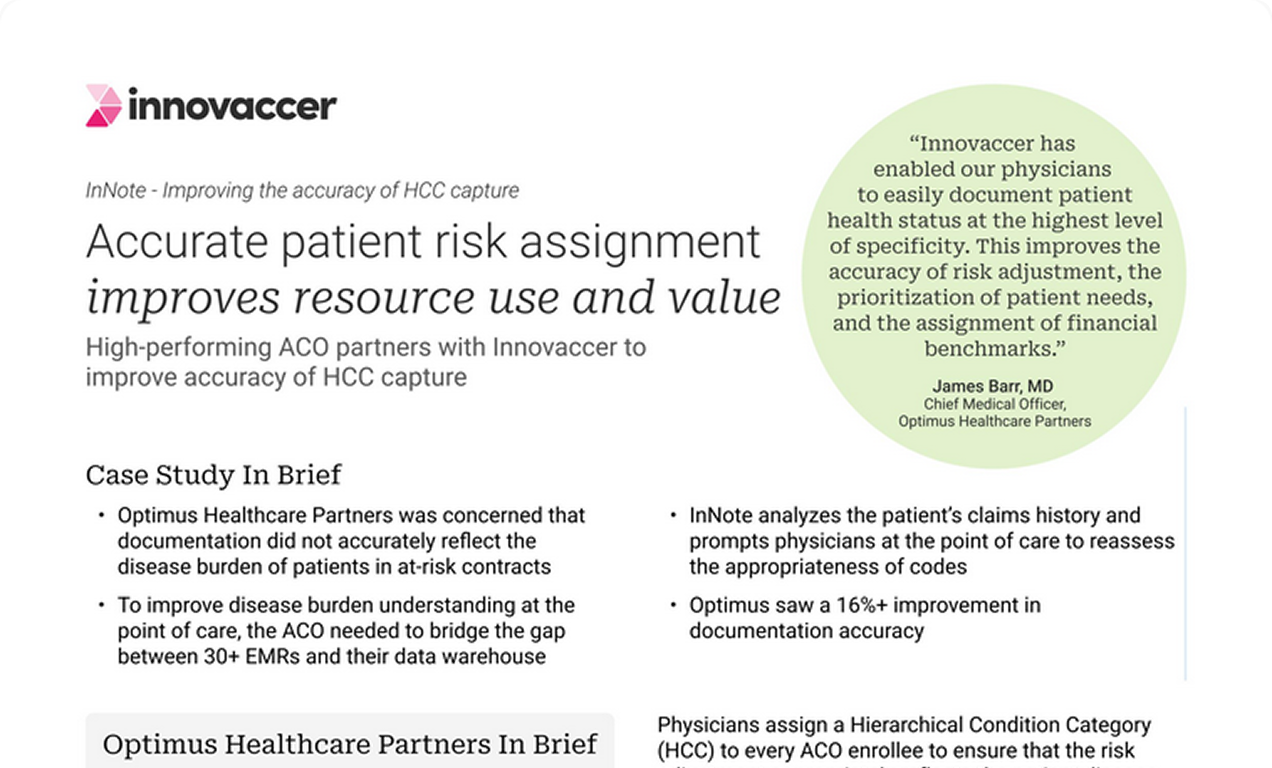

Medicare ACO - Benchmarks are risk-adjusted that are later utilized in shared savings calculations. Risk adjustment is initiated at the population level using the CMS-HCC model.

MA plans - Capitated payments for the following year are risk-adjusted based on accurate documentation and coding (at the diagnosis level & member level using the CMS-HCC model).

Managed Medicaid - Risk adjustment, usually at the population level.

Commercial (ACA) plans - Risk adjustment, usually using HHS - HCC at the population level.

Succeeding in Risk Adjustment

On a larger level, a successful risk adjustment plan has three fundamental goals:

- Enabling members and providers to connect in meaningful ways to document and promote beneficiaries' health and care.

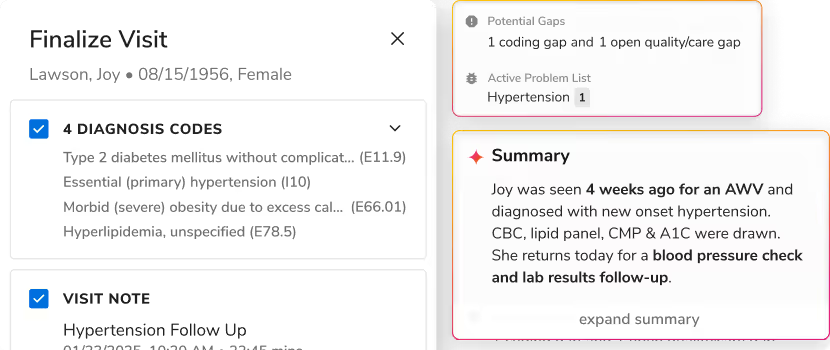

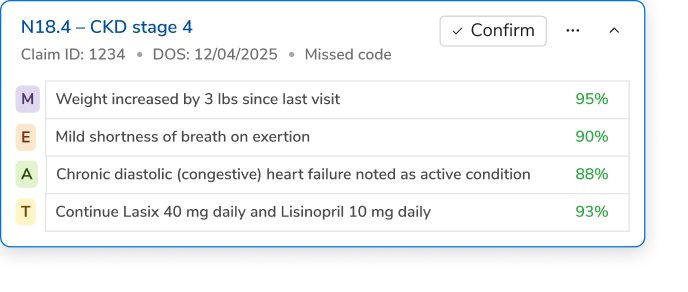

- Ensuring members are correctly assessed and the diagnoses captured and charted effectively.

- Ensuring that submissions to CMS are accurate, compliant with regulatory guidelines, thorough, and comprehensive.

For a risk adjustment program to succeed, health plans must help members and providers engaged with each other with the goal of ensuring quality healthcare delivery. Within the MA and ACA markets, health plans commonly provide a set of defined and generally complimentary or low-cost member benefits such as annual wellness visits, comprehensive wellness exams, and annual physical exams. The goal of these benefits is to encourage members to visit their primary care physician (PCP). The documentation created during these member visits is critical to ensuring an appropriate and accurate risk score.

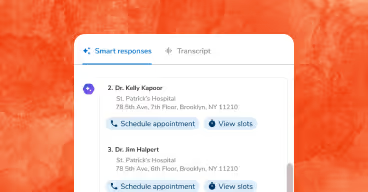

Health plans often use a combination of tactics to encourage these visits. For example, they may send out lists to providers to remind and encourage them to reach out to their attributed members in their patient panel to schedule yearly check-ups. Health plans may also offer some form of reward or incentive to encourage members to visit their PCPs to ensure that they receive the right care at the right time. Member incentives may include, for example, gift cards when a member visits a provider and/or completes certain preventive health procedures. Other tactics include mailing and telephonic outreach campaigns to encourage members to schedule a visit with their PCPs or to attend a clinic fair. Finally, for members with complex health conditions and limited access to transportation, a health plan may offer a provider the opportunity to visit them at their residence for an in-home assessment.

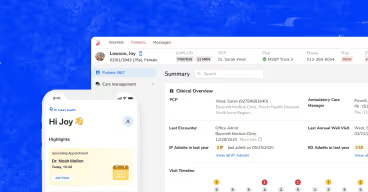

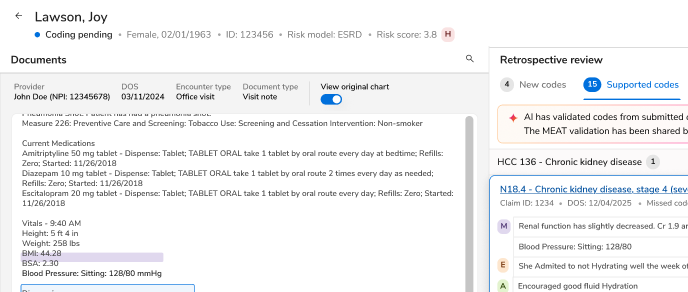

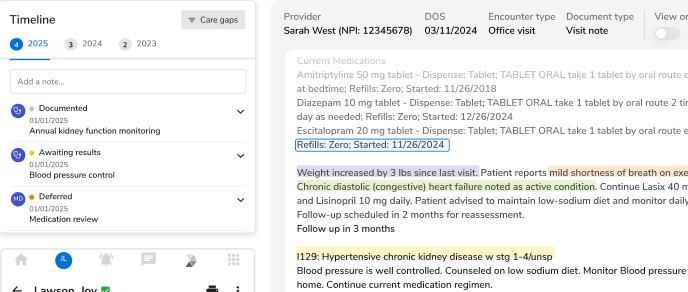

Risk Adjustment at the Point-of-Care

Point-of-care (POC) tools help providers prospectively assess members' medical conditions, reconfirm pre-existing conditions, and refer their patients to preferred physicians. POC tools range in sophistication from simple health risk assessment forms that are sent out to providers on a quarterly basis to clinical decision support systems that are embedded or tied to an electronic medical record. With the advent of computer-assisted coding and electronic medical records, health plans are using more real-time technologies to review medical records and correct claims information. Finally, many health plans are actively reaching out to providers to encourage better charting techniques, survey reconfirmation rates of chronic conditions, and review of potential care gaps for members in providers' patient panels. Unfortunately, claims data do not always accurately reflect a member's true medical condition. To address the problem, health plans use analytics to identify members with potential chronic conditions that are not currently documented. In these instances, markers or indicators in the member's claims data suggest that a medical condition may be present but not represented in the claims data.

Once a list of members with potential encounter data gaps is identified, the health plan requests and reviews the members' medical records. With this new "supplemental" information, the health plan updates its encounter data with CMS, so it better reflects what is in the members' medical records.

Conclusion

Risk adjustment is critical to value-based contracts. It can help increase revenue due to more accurate risk capture for MA plans and increased benchmarks leading to higher shared savings for MSSP ACOs. Not only are there a multitude of organizational benefits, but the reduction in physician time spent on risk adjustment also improves provider satisfaction and reduces the added burden on them. Risk adjustment increases the accuracy of coding and improved throughput leading to a better care delivery system.

Learn how Innovaccer's solution can provide an end-to-end solution for risk adjustment for risk-based providers here.

Book a demo for FHIR-enabled Data Activation Platform to find out how it can help improve overall care delivery.

.png)

.avif)

.svg)

.svg)

.svg)