Rethinking Risk Stratification in Healthcare with AI: The Future Beyond RAF Scores

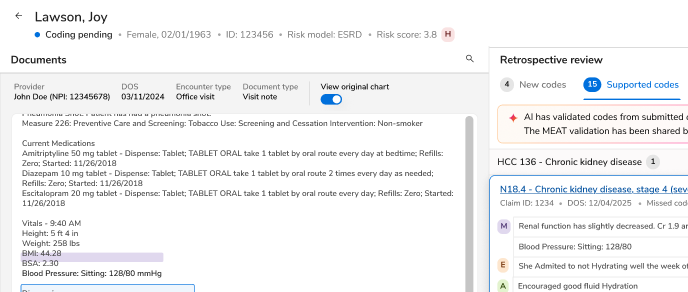

For years, providers and payers have used Risk Adjustment Factor (RAF) scores to project care costs, predominantly in Medicare Advantage risk adjustment programs. However, traditional RAF scores often depend heavily on historical claims data and miss critical insights such as social determinants of health (SDOH) like housing and education. This type of one-size-fits-all model can fall short in today’s complex care landscape, where every patient’s risk is dynamic and multifaceted.

In today's world, where chronic conditions are on the rise and healthcare is shifting towards value-based care, there's a pressing need for smarter ways to identify risks. Thanks to new advancements in artificial intelligence (AI) and predictive analytics, we're seeing a transformation in how we pinpoint and manage at-risk populations.

In this blog, we'll dive into the shortcomings of traditional RAF scoring methods and take a closer look at how innovative technologies are revolutionizing risk adjustment, leading to improved outcomes and more accurate reimbursements.

What are the Limitations of Traditional RAF Scoring in Healthcare?

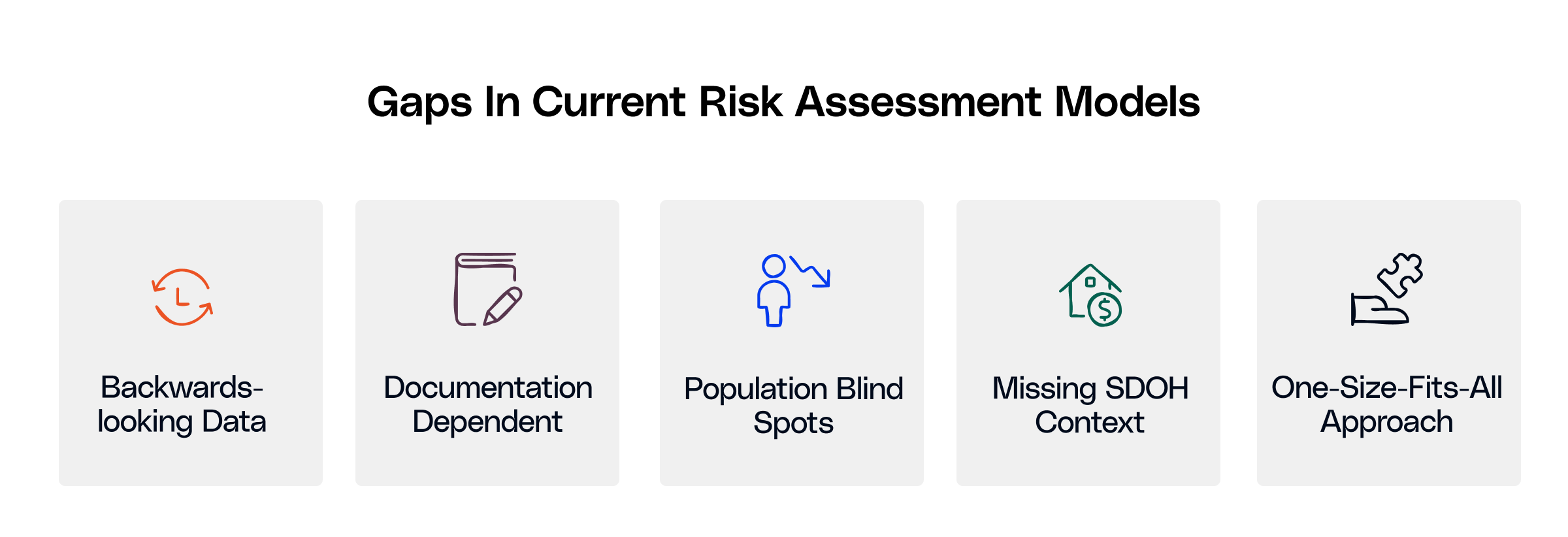

RAF scores are used by health plans to gauge patient risk and adjust payment based on expected costs. Though these scores inform risk-adjusted payments, they have limitations.

- Basic RAF models fail to predict risk for many populations accurately, including younger patients with new chronic conditions, and they are also based on historical medical claims, which may not represent a patient's current or potential future health state.

- RAF scoring models may not capture factors such as housing stability that can impact patient health.

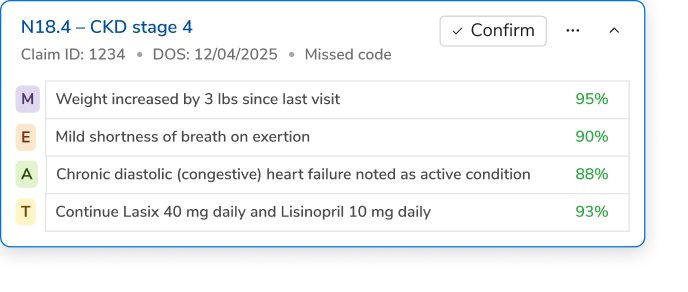

- RAF scores emanate from a documented diagnosis; if a health care provider fails to document or code for a condition during a patient encounter, that condition will not be reflected in the RAF score. This can impact the estimated risk for the patient and potentially underrepresent the needed care plan and/or reimbursement.

Role of AI in Risk Stratification

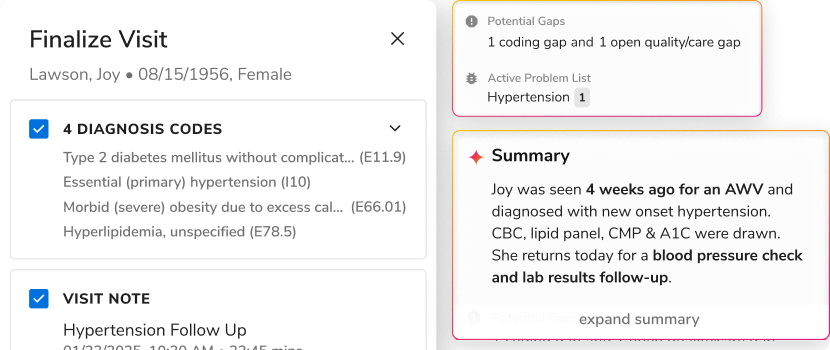

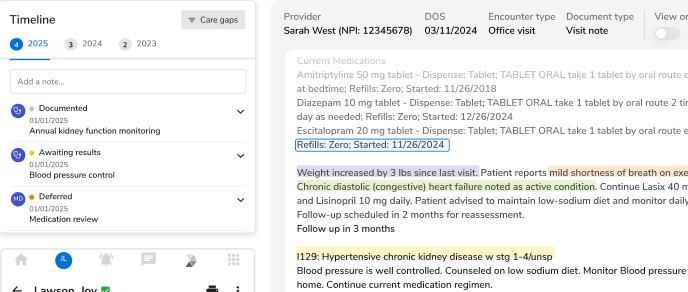

Artificial intelligence is assisting health plans in overcoming the obstacles posed by conventional RAF scores. AI can analyze a multitude of data sources, from electronic health records to social factors, to produce real-time predictions that are much more accurate. AI models are flexible and constantly learning from new data and inputs. This means we can identify patients with high risk earlier. When compared to older scoring methods, AI can deliver more precise risk assessments for individuals or groups based on anticipated behaviors.

If we put in place all the necessary safety nets, AI could greatly enhance the Medicare Advantage risk adjustment and improve overall population health outcomes so that healthcare systems can deliver proactive and effective care. Therefore, we must prioritize transparency and fairness to nurture trust with clinicians and regulatory authorities.

Navigating the Regulatory Landscape for Future Risk Models & Risk Adjustment Factors

As AI-powered tools begin to influence risk adjustment, it's essential to ensure that they align with regulatory requirements. CMS has specific guidelines for how diagnoses must be documented and reported to influence RAF scores. Any AI-driven system must ensure full auditability and compliance. Organizations must ensure that they are conducting full audit cycles and comparing AI recommendations against final submissions to ensure consistency with CMS requirements.

Similarly, HIPAA protects the privacy and security of patient data used in these models, requiring strong safeguards for protecting sensitive information.

AI models must additionally comply with quality and value-based reimbursement measures to be effective. Health plans and providers must ensure that such technology aids, rather than impedes, the delivery of performance-based care and regulatory compliance.

Implementation Challenges and Solutions

While AI-based risk stratification in healthcare offers clear benefits, implementing these tools at scale presents several challenges:

- Complexities with data integration: Merging data from EHRs and claims requires robust infrastructure and adherence to interoperability standards.

- Staff Training: Clinicians and administrative staff need to be trained on how to interpret and act on AI-driven insights. Also, organizations should encourage a culture shift towards data-driven care.

- Ethical and Bias Considerations: If not designed properly, AI models can perpetuate existing healthcare disparities. It is crucial to build algorithms that are transparent, equitable, and regularly audited for bias.

- Initial Costs and ROI Concerns: When it comes to building and implementing AI tools, the initial costs can be quite significant, both in terms of money and time. If health plans can demonstrate a solid return on investment through pilot programs and gradual rollouts, it will be much easier to advocate for further implementation.

This means that health plans will need to tackle these challenges by embracing a mix of technology, training, and governance to effectively and safely use AI in risk stratification in healthcare and drive efficient population health management.

The Road Ahead for Risk Stratification in Healthcare

Looking ahead, as the healthcare landscape continues to change, integrating AI into risk adjustment represents a vital shift from a reactive approach to a more proactive one. Future models for risk adjustment will have to focus on continuous learning, leverage real-time data along and integrate social determinants to provide a comprehensive view of patient health. However, achieving success will hinge not just on the technology itself, but also on a strong commitment to collaboration, equity, privacy, and transparency.

To see how AI is redefining the future of risk stratification, get in touch.

.png)

.png)

.svg)

.svg)

.svg)