Top 7 Healthcare Financial Performance Tools for 2026 Leaders

.jpeg)

Modern healthcare leaders ask a simple question: What are the leading tools for healthcare financial performance in 2026? The short answer: a blend of AI‑driven analytics, automation, and real‑time dashboards that unify clinical and financial data. This guide profiles 10 widely adopted solutions—spanning accounting suites, payment automation, and enterprise analytics—plus Innovaccer’s Healthcare Intelligence Cloud, which unifies fragmented data for system‑wide visibility. Expect clear strengths, trade‑offs, ideal‑fit guidance, and selection criteria to match organization size and complexity. If you need faster close cycles, stronger revenue integrity, and value‑based performance, the tools below offer predictable ROI through automation and actionable, real‑time insights.

Strategic Overview

Financial performance management keeps provider organizations solvent amid margin pressure, staffing shortages, and evolving reimbursement. At its core, revenue cycle management and financial analytics surface accurate, timely data to optimize cash flow, reduce denials, and guide resource allocation. In 2026, leaders should prioritize platforms that combine automation, AI‑driven analytics, and real‑time dashboards—ensuring interoperability with EHRs and claims systems, and scalability for multi‑entity structures. This list reviews industry‑leading platforms with EHR integration patterns, automation depth, implementation considerations, and role‑based analytics for executives, finance teams, and service‑line leaders—so every decision accelerates financial and clinical outcomes.

Quick navigation:

- Flow by Innovaccer

- Sage Intacct

- QuickBooks Online

- FreshBooks

- Plooto

- SoftLedger

- Cliniko

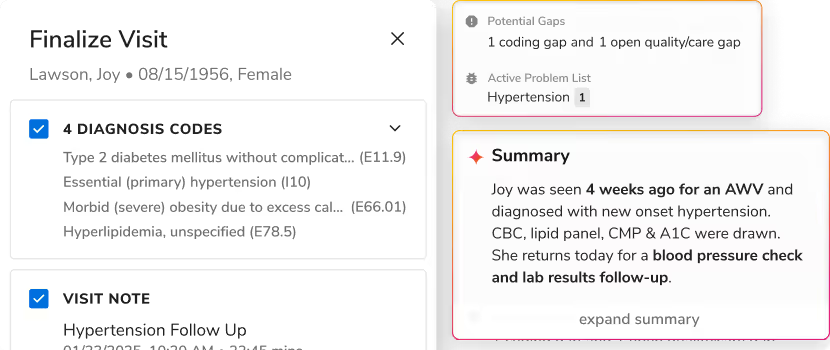

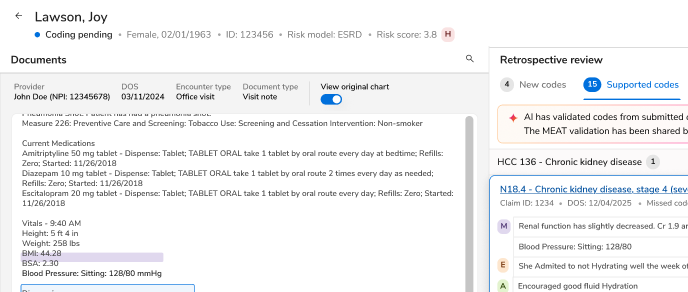

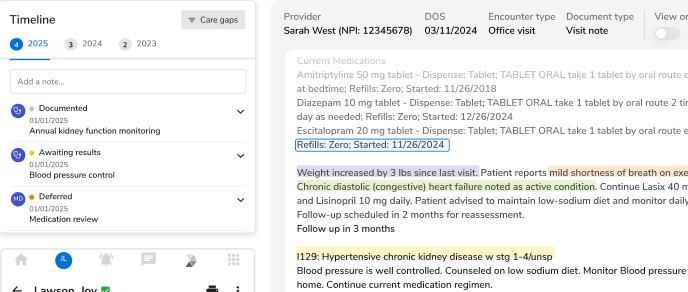

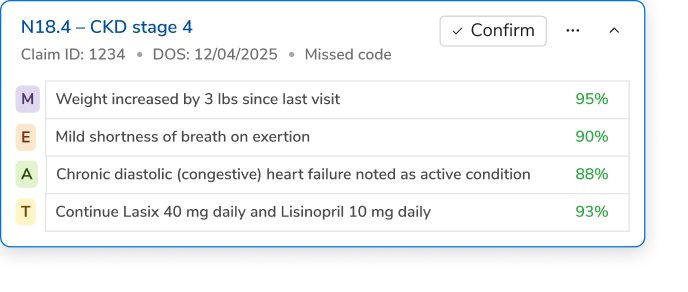

1. Flow by Innovaccer

Flow by Innovaccer unifies clinical, claims, and operational data to deliver real‑time financial and quality performance. The platform integrates seamlessly with major EHRs and billing systems to break data silos and power system‑wide analytics. AI modules across population health, risk adjustment, contract modeling, and quality oversight automate measurement, surface gaps, and drive intervention workflows that improve outcomes and ROI.

- Ideal for: Large health systems, ACOs, CINs, and multi‑entity provider groups needing unified intelligence

- Standout: NCQA‑certified quality tools, contract and RAF analytics, and enterprise‑grade interoperability

- Outcomes: Proven improvements in cost and quality metrics; measurable value‑based care gains

- Learn more: Healthcare Intelligence Cloud, Population Health Analytics, ACO support, quality management benefits

Key Takeaway: Flow by Innovaccer delivers enterprise‑grade data unification and AI‑driven quality analytics, making it a top choice for large, multi‑entity health systems seeking real‑time, value‑based insights.

Transform your financial performance

Flow integrates seamlessly with your existing systems, automating manual tasks with the accuracy of your best staff—minus the burnout.

Learn More

2. Sage Intacct

Sage Intacct delivers a user‑friendly financial suite with healthcare‑specific dashboards and flexible reporting. Its multi‑entity capabilities and automated workflows streamline consolidations, approvals, and resource tracking across service lines and locations. Leaders get role‑based views, granular dimensions, and quick drill‑downs to manage budgets, productivity, and spend.

- Ideal for: Multi‑location groups and midsize systems needing strong accounting and reporting

- Standout: Customizable reporting, automated workflows, and intuitive dashboards

- Scale: Robust multi‑entity management and consolidation support

- Evidence: Sage Intacct features dashboards, automation, and customizable reporting for healthcare use – healthcare accounting overview

Key Takeaway: Sage Intacct balances ease of use with powerful multi‑entity consolidation, making it ideal for midsize organizations that need flexible, role‑based financial reporting.

3. QuickBooks

QuickBooks Online can fit growing healthcare groups that need consolidated financials, flexible reporting, and cash‑flow visibility. With customizable reports and inter‑company eliminations, finance teams can standardize month‑end processes. Larger teams should plan for governance, role design, and training to ensure consistent usage and auditability.

- Ideal for: Expanding practices and groups consolidating across entities

- Standout: Custom reporting, cash‑flow tracking, and eliminations for multi‑entity close

- Consider: Learning curve for complex workflows and enterprise controls

- Evidence: Supports multi‑entity, eliminations, and interactive reporting for healthcare finance – healthcare accounting overview

Key Takeaway: QuickBooks Online offers affordable, flexible reporting for expanding practices, but requires strong governance to scale safely.

4. FreshBooks

FreshBooks is cost‑effective and easy to adopt for small practices and independent providers. It simplifies invoicing, time tracking, and expense management, with friendly support and quick setup. As practices scale, limitations appear in multi‑entity consolidations and advanced healthcare integrations.

- Ideal for: Solo providers and small clinics prioritizing simplicity and low cost

- Standout: Simple invoicing, expense tracking, and strong customer support

- Consider: Limited scalability and healthcare‑specific features

- Evidence: 30‑day free trial; plans from ~$6.30/month for small practices – best healthcare accounting tools

Key Takeaway: FreshBooks is a low‑cost, easy‑to‑use solution for solo and small‑clinic environments, though it lacks deep healthcare integrations.

5. Plooto

Plooto automates accounts payable/receivable and streamlines payment workflows for provider organizations. It’s easy to deploy, affordable, and reduces manual steps in disbursements and collections. Best for straightforward financial ops; complex multi‑entity accounting may require a broader platform.

- Ideal for: Clinics and groups wanting fast payment automation with low overhead

- Standout: Automated payments, vendor management, and simple approvals

- Consider: Narrower feature set beyond payments and reconciliation

- Evidence: Payment automation from ~$9/month with 30‑day trial – best healthcare accounting tools

Key Takeaway: Plooto excels at payment automation for clinics seeking quick, low‑cost disbursement solutions, but isn’t a full‑scale accounting platform.

6. SoftLedger

SoftLedger brings real‑time financial data and flexible reporting to midsize and large groups. It supports multi‑entity consolidation and advanced dimensions, enabling faster close and granular insights. Implementation requires thoughtful configuration and staff enablement to fully leverage dashboards and automations.

- Ideal for: Midsize‑to‑enterprise provider organizations with complex entity structures

- Standout: Real‑time reporting, custom dashboards, and multi‑entity consolidation

- Consider: Setup complexity; invest in training and change management

- Evidence: Real‑time data with flexible report customization and consolidation – best healthcare accounting tools

Key Takeaway: SoftLedger provides powerful real‑time, multi‑entity reporting for complex organizations, provided sufficient implementation resources are allocated.

7. Cliniko

Cliniko, a practice management solution, can streamline financial operations across multiple facilities by aligning scheduling, billing, and reporting under one roof. Its multi‑location views help standardize workflows and reduce internal friction between clinical and administrative users. Large health systems may outgrow its capabilities and require enterprise analytics and consolidation tools.

- Ideal for: Practice groups managing multiple facilities with unified scheduling and billing

- Standout: Multi‑location reporting and simplified inter‑facility workflows

- Consider: Scalability constraints for enterprise‑level financial consolidation

- Note: Pair with enterprise analytics if pursuing system‑wide value‑based performance

Key Takeaway: Cliniko offers an integrated practice‑management experience for multi‑site groups, though larger systems will need supplemental analytics platforms.

Conclusion

Choosing the right healthcare financial performance tool hinges on aligning organizational size, integration needs, automation depth, and AI capabilities with vendor strengths. Enterprise platforms such as Flow, Sage Intacct, and QuickBooks excel at data unification and value‑based analytics for large systems. Mid‑market groups benefit from flexible accounting suites like Sage Intacct, SoftLedger, and Vena, while small practices thrive on lightweight, cost‑effective solutions such as FreshBooks, Plooto, and Cliniko.

A disciplined selection process—starting with a requirements matrix, piloting, and rigorous change‑management—ensures smooth adoption, measurable ROI, and scalability for the next three years of value‑based care transformation.

Frequently Asked Questions

What features distinguish top financial performance tools for healthcare?

Leading tools pair real‑time analytics with automation to eliminate manual work and accelerate decision‑making. Expect customizable, role‑based dashboards, reliable integrations with EHR/claims systems, and governance features like audit trails and access controls. Multi‑entity support and consolidation are critical for groups operating across multiple facilities. AI‑driven analytics should surface anomalies, predict denials, and identify cost variances, while workflow automation streamlines approvals, posting, and reconciliations to improve cash flow and reduce errors.

How do these tools support value‑based care initiatives?

They unify financial, clinical, and claims data to measure outcomes and costs at patient and population levels. Contract modeling and risk‑adjustment analytics forecast shared savings and downside exposure, while automated quality reporting aligns teams to HEDIS and NCQA measures. Real‑time dashboards track performance against targets, highlighting care gaps and cost drivers. Together, these capabilities enable proactive interventions, compliant reporting, and optimized reimbursement tied to quality and efficiency.

What are best practices for implementing healthcare financial software?

Start with a requirements matrix and a current‑state process map to identify automation and analytics wins. Prioritize interoperability with EHRs and claims systems, define data governance, and standardize shared dimensions. Pilot with cross‑functional users, measure time‑to‑close and denial rates, then iterate training. Build change management into the plan: appoint product champions, create quick‑reference guides, and set reporting cadences. Finally, track ROI quarterly and recalibrate workflows based on measured outcomes.

How do healthcare financial tools ensure data security and HIPAA compliance?

Vendors should provide encryption in transit and at rest, role‑based access, MFA/SSO, and comprehensive audit logs. Confirm HIPAA‑aligned policies, BAAs, and certifications such as SOC 2 and HITRUST. Evaluate incident‑response and disaster‑recovery plans, including RPO/RTO. For audits, ensure reproducible reports, data lineage, and evidence trails. Strong identity governance and least‑privilege access further reduce risk while supporting regulatory and payer requirements.

Which tool types are best suited for large health systems versus smaller practices?

Large systems benefit from enterprise platforms that unify data and support AI‑driven analytics, multi‑entity consolidation, and robust governance—options like Flow by Innovaccer. Midsize groups often pair accounting suites with advanced reporting tools—Sage Intacct, SoftLedger, and Vena. Smaller practices prioritize ease and affordability—FreshBooks, Plooto, and Cliniko—and can layer analytics as they grow. Choose the smallest tool that reliably meets requirements while leaving room to scale.

.png)

.png)

.avif)

.svg)

.svg)

.svg)