VBCRM Part III: Keeping Patients Loyal and Engaged for Life in a Consumer-Driven Marketplace

Like any retailer, hospitals now need to adhere to the four commandments of consumerism: understanding their customers, meeting their needs, retaining them as customers, and expanding their customer base. But unlike any retailer, in the extraordinarily complex business of healthcare, that’s easier said than done. Here’s how to crack the code.

If you think the hospital business is complicated now, you ain’t seen nothing yet.

Consumerism is challenging enough for any business in a “normal” industry that supplies a relatively limited set of products or services. Think automakers, airlines, retail stores like Targetor Home Depot, food services businesses like Starbucks; or even a massive, sprawling “everything” digital store like Amazon.

But the healthcare industry—and hospitals in particular—are in a whole other league. Their business is to sell care (FFS) or sometimes health (VBC), which are two very different and multi-faceted offerings. Their consumers are also patients (sometimes with very complex needs) and only occasionally paying customers. They must typically execute those transactions with the real buyers (health plans, the government, employers) who might have different priorities than the patients and their doctors.

The services they end up providing are influenced, directed, or constrained by those stakeholders, among other factors, and could look very different under different circumstances. For example, different doctors might prescribe different treatments. Different plans might not authorize the same drugs or tests. Different costs might be applied to the same services, depending on contracts. Different patients might have different holistic needs. And every provider who follows in the referral chain might take that care in a different direction.

What’s more, the ultimate quality of outcomes—clinical, financial, experiential—are not entirely in the hands of the provider. Rather, they’re even more dependent on the conditions, circumstances, behaviors, and proclivities of their patients. In that world, what does it take to achieve excellence, to become profitable, to outcompete more nimble, retail- and tech-savvy competitors, and to satisfy the rapidly evolving expectations that patients/consumers have for service, convenience, support, and quality?

Fortunately, some of the fundamental rules of business also apply in healthcare, despite all the interdependencies mentioned above. To succeed, hospitals must observe the four commandments of healthcare consumerism:

- Know thy customer

- Provide what thy customer needs

- Keep thy customer (who is now thy patient)

- Increase the number of thy customers

All the while, of course, managing costs to maintain or grow margins and, ideally, sustain and increase profitability.

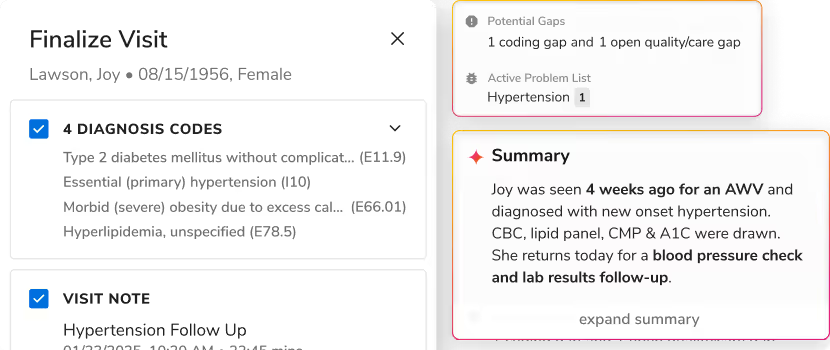

In the first article in this series, we looked at “Finding” patients, which requires knowing them. In the second, we looked at “Guiding” patients, which is about providing the care (and support) they need throughout the continuum of care. In this article, we’ll delve into what it takes to “Keep” patients, which is about fostering their ongoing engagement and loyalty—and so much more.

The key to all that is data. At the risk of sounding like a broken record, and to reiterate what our two previous articles stressed, the default data systems of today (traditional EHRs and CRMs) are insufficient for integrating the universe of data necessary for a health system to achieve and act with systemness, and deliver quality consumer experiences while achieving clinical and revenue goals.

Under FFS medicine (a-k-a “sick care”), keeping patients is all about enticing them to remain loyal to the provider the next time, and every time they need care. Under VBC (“wellness care” or “preventative care”), it’s about engaging patients in a care management program that improves their health.Once again, a value-based CRM that brings CRM, pophealth, and digital experience data, insights, and workflows together—independent of payment models—is the foundation for success in a healthcare market that’s changing fast.

Embracing Loyalty (FFS) and Engagement (VBC)

It’s far more profitable to keep a customer than it is to gain a new one. In most industries that truism is entrenched and essential to marketing efforts, service line strategy, and more. According to HBR, increasing customer retention by just 5% boosts profits by 25% to 95%. Related: the Pareto Principle of marketing holds that 80% of your profits come from just 20% of your customers.

Obviously, and as we’ve stated, healthcare is not just any industry. But Bain estimates that a similar 5% increase in patient loyalty also boosts profits by a conservative 25%. It’s also indisputable that, as with other industries, it’s easier to “sell” to an existing healthcare customer than a new one, and that a certain percentage of patients generates substantially more profit (or costs!) than others

How do you keep the patients you have? How do you keep the patients you want to have? Or, in a value-based world, how do you make sure those patients don’t blow a hole through your operating budget by not adhering to the program your organization meticulously designed to keep them healthy?

Loyalty and Engagement in the Real World

| For 82% of companies, customer retention is cheaper than acquisition. | Increasing customer retention by just 5% boosts profits by 25% to 95% |

| 80% of your profits come from just 20% of customers – who are they? | The probability of selling to an existing customer is 60-70% |

| 56% of customers stay loyal to brands that “get them” | 77% of brands could disappear, and no one would care |

| Brands which are meaningful and viewed as making the world a better place outperform the stock market by 134% | 75% of consumers expect brands to make more of a contribution to their well-being and quality of life—shouldn’t healthcare have a leg up on other industries? |

| 96% of US consumers say customer service is very important when it comes to their loyalty to a brand | 73% of companies with above-average customer experience perform better financially than their competitors |

| Loyal customers are 5 times more likely to make a repeat purchase | 74% of millennials will switch to a different retailer if they receive poor customer service |

| 50% of US consumers have left a brand they were loyal to for a competitor that better met their needs |

Customers become loyal to a business or a brand because they associate it with a certain experience, value, or social cache. This loyalty encourages repeat business, though that’s never a sure thing and is always up for grabs. Nevertheless, humans are surprisingly loyal to their previous preferences. Over 50% of car buyers, for example, will buy multiple cars from the same manufacturer, even over decades. Think Tesla. And certain brands are stickier than others. Many people who love Diet Coke wouldn’t think of buying another brand. But many who go to Starbucks and might also love the brand would still get a latte somewhere else if it’s more convenient.

Businesses use loyalty programs to help tilt the odds in their favor. Though existing in some form or other since the 18th century (and perhaps the entire history of commerce), modern-day loyalty programs were first used by the airline industry in 1981 with the introduction of the frequent flier program by American Airlines and United Airlines.

Today most large businesses have some form of loyalty program. The best programs boost revenue from enrolled consumers by 15% to 25%. Starbucks is typical of businesses that give reward points which can be used to make more purchases. Amazon uses the membership model for its Amazon Prime program, offering free shipping, streaming content, and an array of other services and discounts to people who pay an annual fee.

Loyalty has certain benefits, such as increasing:

- Brand retention

Repeat purchases from past customers

- Customer lifetime value

Or “CLV,” the measurement of how valuable a customer is across the entire customer relationship

- Revenue

Also called income, revenue is the amount of money a company brings in

- Competitive advantage

How a company can produce goods or deliver services better, more profitably, and gain more market share than rivals

In healthcare, the purpose of loyalty is to encourage repeat business among FFS patients thereby increasing patient retention, reducing patient acquisition costs and churn, and improving net promoter scores. It should also, ideally, encourage the consumption of more services. The knee replacement patient should get their rehab through the same health system and come back for the other knee when needed. Increasing retention by 1% leads to a 4% improvement in projected patient lifetime value.

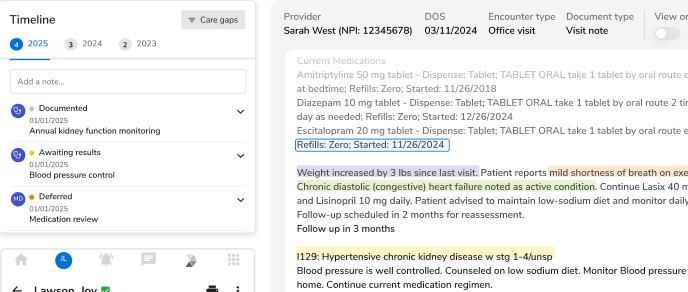

Loyalty is enhanced by consistent experience, quality, and value which creates a sense of trust, reliability, and cachet around the brand. All of that can enhance engagement, which is critical in VBC. But engagement is less transactional and requires a more collaborative relationship between patients and providers—something the EHR doesn’t do well or at all. That collaboration is bolstered by regular check-ins, ongoing monitoring, lots of well-timed and clinically contextual communication, and education meant to foster adherence and self-empowerment—all of which can be routine (and, ideally, automated) processes that should continue as a life-long engagement with the patient.

The goal is not to forget the patient exists (which is what often happens), but rather, to sustain the relationship through steady engagement, and ensure they’re getting the care and intervention they need as early in their disease progression or prevention program as possible, at the lowest cost—and to do so across a panel of patients that can number in the thousands.

In other words, it’s about changing behavior over years and even generations. Reducing obesity? Change a population's behavior. Controlling diabetes and addressing mental health challenges often requires deep engagement with the individual and their community. Again, none of these activities (sustaining loyalty or engagement) can be accomplished at any scale without a holistic view of the patient, which itself requires unified patient records that the EHR or CRM system alone was never designed to provide.

Baby, You Can Drive My Car: the FFS Story

To foster loyalty, healthcare providers have long relied on patients’ relationships to their physicians, convenient location, health plan restrictions, and community reputation. Today, most providers also use patient satisfaction surveys as crude tools to assess and address loyalty.

But those days are over. As price, retail service, telemedicine, convenience, and so on, come into play with patients’ consumer decisions, fee-for-service providers are about to get a crash course in what customer loyalty is really based on. Here's an example of how data, service, messaging, and experience can go together to improve loyalty, stickiness, repeat business, upselling, and cross-selling.

Recently, a friend bought a Jeep. During a cold snap this winter, the Jeep told her that her tire pressure was 7 PSI too low on each tire. So she added air. She probably wouldn’t have noticed without the dashboard message. A month later, she got another message. This time the Jeep told her that it needed an oil change.

She was out of town for the next week, and had a long drive back, so she pulled into the express lane of the local Jeep dealership. Driving into the garage bay, sensors did a detailed reading on the condition of her tires, noting their wear and recommending a rotation now and replacements within the next three months.

When she checked in at the front desk, the service attendant asked for her name. Since she’d never been to this dealership before she expected to have to give the history of her vehicle and all her personal information. But they already had everything they needed to know about her in their system, and told her they’d get everything else they needed to know about the Jeep from the vehicle itself.

And guess what? If her Jeep was a little older, she was in the right place to check out a new vehicle and inform her future repeat buying decision.

Why Can’t Healthcare Providers Do That?

- Timely reminders for service by email or text, or with lights or messages on your own personal “digital dashboard”

- Convenient express access when necessary and appropriate

- A slick app that works great on both a smartphone or desktop computer, instead of a clunky portal that offers (at best) a level of interaction with your clinician that feels like a 1990s retro computing site

- Full understanding of “who you are” when you arrive—no need to fill out the same forms over and over and over, no handing over a clipboard with a Bic pen attached

- No need to guess your condition or history—your longitudinal health record is there to tap, and accurate data from whatever monitors, wearables, tests, or images you’ve received are also readily available

- Free snacks, beverages, WiFi, and workstations while you wait—well, let’s not get crazy, but wouldn’t that be nice and noteworthy?

- Easy (and clear) payment, scheduling/rescheduling, and referrals, with automated reminders

- Relevant, helpful messages after the visit

- And relevant, resonant, helpful marketing and reminders over the long run

All of that data and service reinforces the relationship and loyalty a patient has with that provider and their brand. In this way, episodic transactions are transformed into long-term relationships which also open doors to an expanded array of services.

Of course, the current reality of the healthcare experience is far from that. Patients regularly complain about lack of access or convenience, the need to reenter the same information over and over, the long waits, and the poor “customer” service. They don’t really get timely, helpful reminders about “maintenance” (wellness) or detailed information about ongoing “repairs” that need to be done. Their wearable data might as well not exist, and digital access to their long-term records and relevant tests and images is iffy at best. And a smartphone app? What smartphone app?

As retail players like CVS, Walgreens, and Walmart come into the market, will health systems and traditional providers become the care destinations of last resort? Or will they be effectively obsolete—the Borders of of 2011? The Blockbuster of 2010? Or worse, be converted into condos or office space? It’s their choice. And if their choice is to go or remain “all in” with their EHR and old school Healthcare Customer Relationship Management CRM alone, the destination of last resort option will become a harsh reality faster than anyone can imagine.

On their own, traditional CRMs or EHRs can’t provide the data needed to infuse patient experience with that level of service and value. They don’t have access to all the data they need, they can’t integrate data across different provider functions let alone from outside sources, and they don’t have a deep enough knowledge of the individual to support the relationship in a way that is truly meaningful, personal, and enticing.

From Weight-Watching to Behavior Change: the VBC Story

And that’s the kind of data, systemness, and personalization necessary to succeed in value-based care programs, too. The goal in value-based care, however, is not to encourage repeat business of high-margin services; but to enhance health and wellness outcomes with the lowest-cost, highest quality services possible, while simultaneously influencing an individual's health behavior over time.

This doesn’t happen by ignoring patients or hoping they go away. That’s how traditional gym memberships or diet programs work. They maximize profit when customers engage less. That’s not a successful business model in a world where health is the goal, as weight loss company Jenny Craig determined before it recently ceased operations.

In recent years, Jenny Craig faced intensifying competition as traditional competitors and newer entrants increased customer engagement by copying what Jenny Craig did best, then adding digital channels that enhanced experience, personalized coaching programs, and customized meal programs.

Meanwhile, Jenny Craig’s customers—increasingly unmoved by the company’s traditional marketing (before and after photo stories) and celebrity endorsement strategy, grew dissatisfied with higher prices, calorie restrictions, and inflexibility—and took their loyalty elsewhere. Personalized relevant engagement was the new way to win, and Jenny Craig missed the boat.

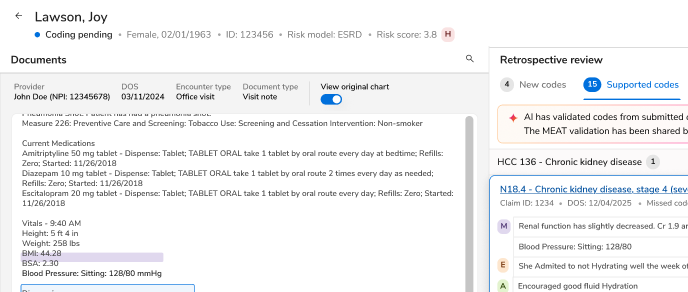

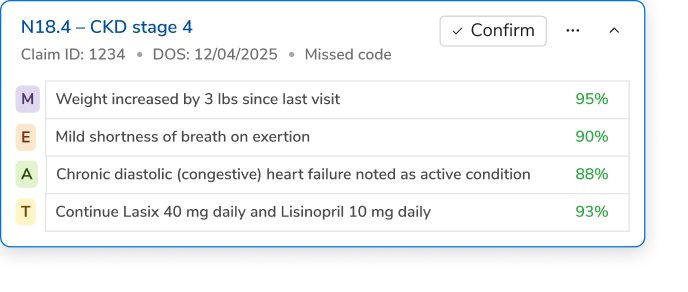

Similarly, health care providers in value- or risk-based arrangements need access to holistic patient and population data that goes far beyond traditional clinical (EHR) or marketing (CRM) data. They need to know everything about the patient, including their physical and behavioral health status, socio-economic circumstances, personal behaviors, and more—in order to provide personalized and clinically individualized messaging, appropriate support and engagement, and the right care paths.

That data must be aggregated from many different sources, normalized, and made actionable and accessible for everyone on the care team, within their existing workflows, while also triggering automatic prompts, processes, and communications that help change behavior and keep patients engaged. It must also feed and be reinforced by digital channels that increase engagement, rather than detract from it. The more “relevant and personalized” the better.

Conclusion: Everything Everywhere All At Once

Strikingly, in both FFS and VBC business models, it is about having the right data and the right message, to deliver the right care to the right person at the right time, all the time.

In a fee-for-service world, Keep is about increasing care retention and loyalty to ensure patients stay in-network and come back for other services. In a population management model, Keep is about increasing engagement to ensure that high-risk patients adhere to their treatment and care paths, while developing the self-reliance and empowerment needed to take charge of their own health and wellbeing as much as possible, adopting new behaviors, lifestyles, and mindsets.

To compete in a sophisticated consumer-focused marketplace, healthcare providers need to succeed at both fee-for-service and population health simultaneously—and they need robust, accessible, comprehensive patient data to do it.

Right now, patients are fundamentally unknowable because they are one patient when they show up in an emergency department with a broken arm, a different patient when they get checked for strep via a televisit, another patient when they schedule a knee replacement, and another when they get a call from their care navigator about their latest blood sugar test. Multiply that by all the other times a patient interacts with the health system, and you get the chaos of the multiverse.

Today’s care provider can’t function at a high level of performance without bringing all of their consumer, patient, and population data together at once, and have it at their fingertips whether that’s for the marketer, the physician, or other clinician. When a health system is gifted with that level of patient knowledge, and the patient is gifted with that level of personalization, they will reward their care provider with the kind of loyalty and engagement that meets or exceeds clinical and financial objectives no matter what reimbursement model is in play.

When a care provider can do that for all of its patients, and not just a handful, it’s well-positioned for market success against the retail giants (e.g., Amazon, CVS, Walmart, etc.) of the world, and will reap the rewards of growth in the new, technologically integrated, digitally engaged healthcare universe.

How Can Innovaccer Help?

The Innovaccer platform’s Enterprise Customer Relationship Management (CRM) solution uses a unified patient record to boost patient acquisition, enable clinically personalized patient journeys, enhance retention, and improve the bottom line.

By integrating and activating all patient data through a longitudinal consumer/patient record, health systems can attract new consumers more effectively; accurately guide patients throughout their care journey; and better coordinate episodes to improve experiences, care, and your organization’s financial outcomes.

As the industry’s only Enterprise CRM built from the ground up exclusively for healthcare—populated with all of your relevant CRM, EHR, HIT, consumer, and patient data from day one—there’s simply nothing else like it in healthcare … and no faster way to get started accelerating your success with consumer and patient engagement.

About Innovaccer

Innovaccer Inc. is the data platform that accelerates innovation. The Innovaccer platform unifies patient data across systems and care settings, and empowers healthcare organizations with scalable, modern applications that improve clinical, financial, operational, and experiential outcomes. Innovaccer’s EHR-agnostic solutions have been deployed across more than 1,600 hospitals and clinics in the US, enabling care delivery transformation for more than 96,000 clinicians, and helping providers work collaboratively with payers and life sciences companies. Innovaccer has helped its customers unify health records for more than 54 million people and generate over $1 billion in cumulative cost savings. The Innovaccer platform is the #1 rated Best-in-KLAS data and analytics platform by KLAS, and the #1 rated population health technology platform by Black Book. For more information, please visit innovaccer.com.

The VBCRM Series

.png)

.png)

.avif)

.svg)

.svg)

.svg)